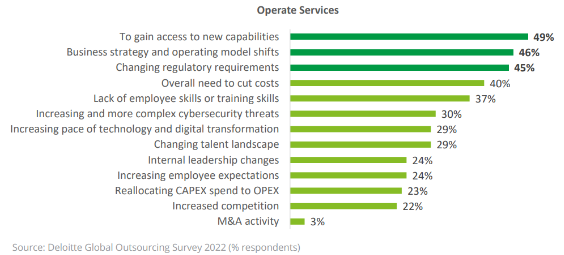

Access to new capabilities. That’s one of the key drivers behind the uptick in outsourcing trends, especially for executives looking to outsource operational services like technology and finance.

According to the report, The State of Outsourcing 2022, conducted by Deloitte–about half (49%) of executives listed new capabilities as their top reason, followed closely by business strategy and regulatory needs.

Understanding the Strategic Value of Outsourcing Finance

The real benefits of outsourcing accounting and finance functions go deeper than cutting costs. Sure, cost is a key driver, but so is value. More companies of all sizes are taking a fresh look at outsourcing as a strategy to manage costs, access talent, add value, and manage risks.

Outsourcing is Cost-Effective

In Deloitte’s survey, 40% of executives indicated that an overall need to cut costs in an increasingly competitive business landscape has renewed their interest in exploring outsourcing partnerships.

For example, a growing marketing agency might receive an influx of capital from an incubator, participate in a corporate-funded grant program, or just land a larger contract than they’ve previously delivered. Those circumstances can fuel immediate growth but also come with labor-intensive reporting requirements.

The in-house accountant does not have the bandwidth to fully reconcile books, expenses, or balance sheets on a monthly basis which in turn makes year-end reporting periods chaotic, causing missed reporting deadlines that directly threaten funding.

By outsourcing finance and accounting activities, this agency can increase visibility and stay on schedule to avoid costly reporting delays.

Here’s how outsourcing can achieve cost-related goals:

- Lower Committed Labor Costs

- Eliminating Infrastructure Expenses

- Accessing Talent Without Recruiting Costs

- Spending Less on Training, Development and Oversight

- On Demand Scalability

While the cost of outsourced services may not always be a cheaper dollar amount than maintaining a single in-house position, potential cost savings come in many different ways. The net result is a cost-effective solution, not necessarily a lower-cost solution.

Leverage Expertise and Specialization

The talent landscape is changing. According to LinkedIn’s Global Talent Trends report, hiring is down over the past year–between 19% and 42% depending on the industry. However, the downward trend isn’t due to a lack of need.

The way that businesses are meeting their needs is changing.

- Upskilling

- Internal Mobility

- Outsourcing

According to McKinsey & Company, a 68% majority of US-based companies are investing in upskilling to meet evolving talent needs. And many of them are working directly with outsourcing providers to help train internal staff, ensuring continuity and enabling scalability with an approach that utilizes internal and external talent.

And LinkedIn agrees, revealing that 16 out of 19 industries surveyed in the Global Talent Trends report show significant growth in internal mobility, giving solid evidence that slower-than-average hiring rates don’t necessarily correlate to a drop in demand.

In 2022, finance outsourcing grew by 10%. And according to The Everest Group, double-digit growth is expected to continue in the finance and accounting outsourcing (FAO) market. This means that companies of all sizes, ranging from small businesses to enterprise-level corporations, are using FAO to meet talent needs.

Outsourcing operational services like accounting and finance can connect growing companies to executive-level finance talent while also helping larger companies overcome skills gaps to keep all their bases covered.

Set up a free consultation with one of our experts today.

Do What You Do Best–Focus on Core Services

The end goal of operational efficiency is being able to spend more time working on your business and less time working in it. From entrepreneurs all the way up to billion-dollar enterprises, the goal is the same. Companies want to maximize efficiency, spending less to make more.

For most eCommerce companies, as an example, core services include technology, user experience design, customer service, and logistics. While these companies may employ a few skilled positions to handle accounting and finance, this is not their domain of expertise. It makes sense that outsourcing to an FAO firm could improve their ability to execute on their core services.

Be in a Better Position to Meet Regulatory Needs

Forty-five percent of executives in Deloitte’s Outsourcing survey cited changing regulatory needs as the primary reason for exploring outsourcing strategies.

Among the top priorities for CFOs today, are changes affecting:

- Global Tax Strategy

- Data Privacy Regulations

- Accounting Standards

- Compliance & Risk Management in the Age of Artificial Intelligence

- Use of Technology & Automation in Accounting

Governance continues to evolve as technology evolves. Outsourcing to an accounting and finance firm is often a proactive step in maintaining compliance through shared risk. In other words, a firm that specializes in finance is better positioned to meet compliance needs and better equipped to address shortcomings than a company that specializes in marketing or consumer goods.

Choosing to Outsource Your Business Financials Comes with Benefits

The take-home message here is that there are plenty of benefits that come along with the decision to outsource finance and accounting tasks. Today, outsourcing is more than a cost-cutting measure, it’s a strategic maneuver.

Working with the right outsourcing provider can open the door to a strategic partnership that provides your business with the efficiency and expertise that you need to meet your operational goals.

James Wheeler

https://www.linkedin.com/in/jamesdavidwheeler/James Wheeler is a fractional CFO and the founder of kept.pro, which provides a proven outsourced accounting department model for growing companies with $2M–$50M in annual revenue. He brings 15+ years of executive finance leadership across services and technology businesses and was twice a finalist for the San Diego Business Journal’s CFO of the Year. James holds a BA in Economics and an MBA from UC San Diego, completed executive education at MIT Sloan, and has served on nonprofit and for-profit boards.